La dichiarazione dei redditi è un documento di natura contabile attraverso cui il contribuente trasmette al Fisco i dati relativi ai propri Redditi percepiti, versando con essa, le Imposte calcolate.

In Italia è il cittadino stesso a quantificare l’insieme dei propri Redditi, che poi trasmette all’Agenzia delle Entrate attraverso il Modello 730 o il Modello Redditi.

Per i detentori di NFT, vediamo a cosa bisogna far attenzione.

Nella Dichiarazione dei Redditi 2023 (Redditi 2022) gli NFT vanno così dichiarati:

1) Compilare Quadro RW (per tutti)

2) 26% su Plusvalenze (CashOut) indipendentemente da Giacenza Media o Franchigie

3) Compilare Quadro RT indicando eventuali Plusvalenze

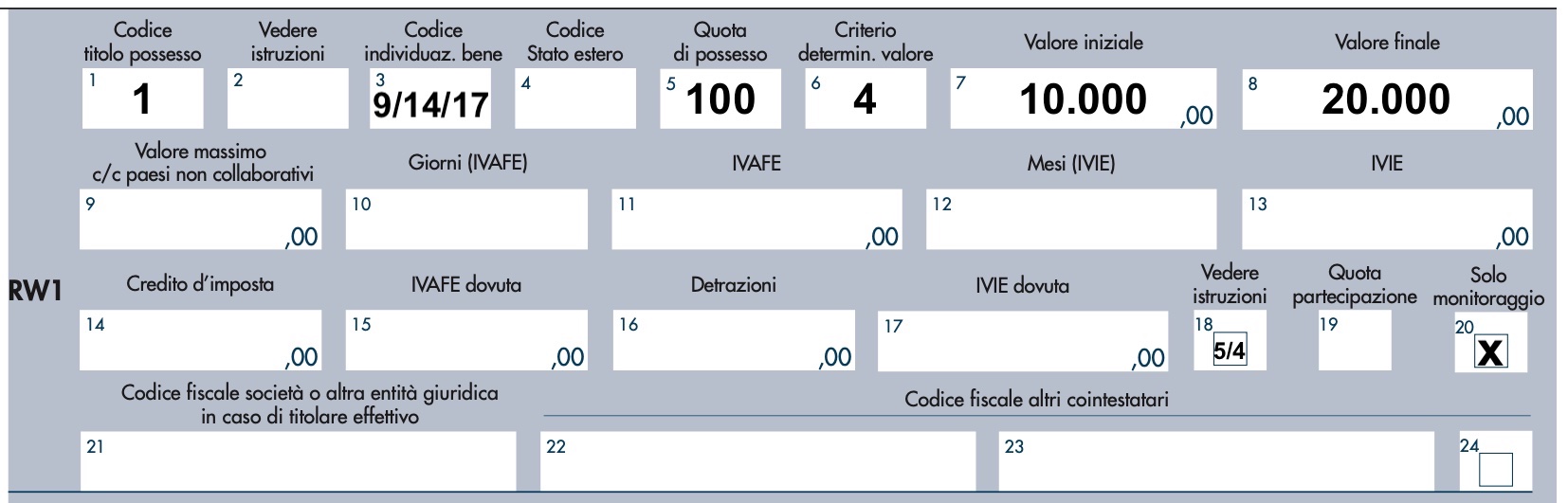

COMPILAZIONE QUADRO RW (foto in basso)

➡️Obbligatorio per chiunque possieda NFT (anche se non ha realizzato plusvalenze)

➡️Compilazione diversa rispetto a quanto visto per le Crypto

➡️Caselle da compilare:

-CASELLA 1: 1 (indica che si è Proprietari dell’NFT)

-CASELLA 3: codice varia in funzione Natura Bene:

“9” se NFT è un UTILITY TOKEN (NFT che ci fa accedere a determinati servizi)

“14” se NFT considerato come “ATTIVITÀ ESTERE di Natura Finanziaria”

“17” se NFT considerato come “Opera d’Arte”

CASELLA 5: 100 (dichiariamo la nostra quota di possesso NFT)

CASELLA 6: 4 (Costo di Acquisto come criterio di determinazione del Valore)

CASELLA 7: VALORE DI ACQUISTO NFT (esempio in foto 10k)

CASELLA 8: VALORE FINALE NFT (al 31/12 dell’anno di Imposta di riferimento)

CASELLA 18: codice varia a seconda se dovete compilare quadro RT (plusvalenze) o meno:

“5” ➡️ NO PLUSVALENZE

“4” ➡️ SI PLUSVALENZE (Quadro RT da compilare)

CASELLA 20: Barrare per far riconoscere che si compila ai soli fini del Monitoraggio Fiscale

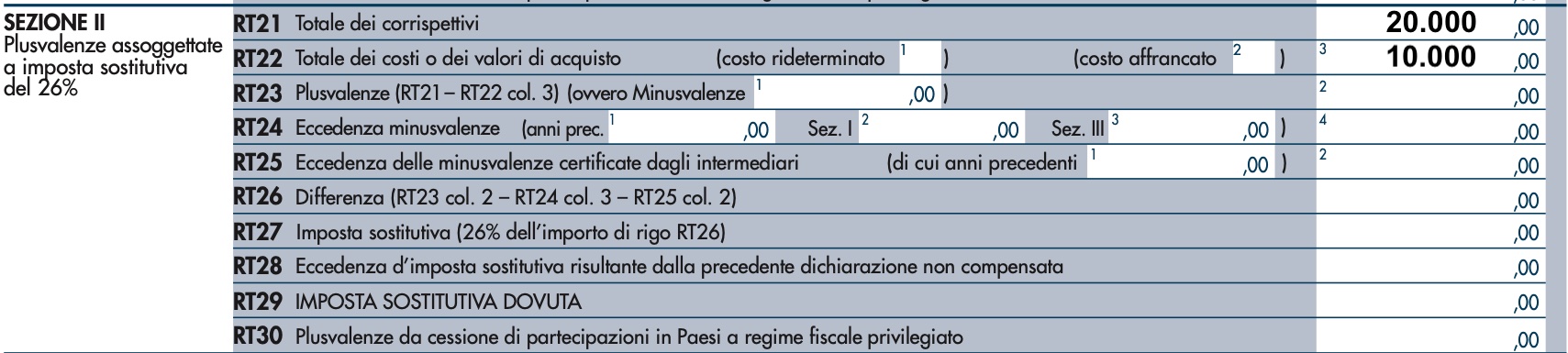

COMPILAZIONE QUADRO RT

➡️Indichiamo nelle rispettive CASELLE (esempio in foto):

1) VALORE D’ACQUISTO

2) VALORE CORRISPETTIVO di VENDITA

➡️La PLUSVALENZA generata (10k nell’esempio in foto) è assoggettata a IMPOSTA SOSTITUTIVA 26% indipendentemente da GIACENZA MEDIA o FRANCHIGIE

➡️NO MINUSVALENZE DEDUCIBILI

-Si ricorda inoltre, che per tutti i Contribuenti persiste:

➡️OBBLIGO del Contribuente CONSERVARE IDONEA DOCUMENTAZIONE attestante Natura Operazioni (transazioni)

➡️OBBLIGO poter DOCUMENTARE PROVENIENZA DENARO Transazioni effettuate (normativa antiriciclaggio)

SEGUICI SU TWITTER (@cryptolegaltec) e Ascolta i nostri PODCAST su SPOTIFY (Crypto Diritto e Fisco) per restare sempre aggiornato e supportarci!

Great, thanks for sharing this blog articleReally looking forward to read more Cool

There is visibly a bundle to realize about this I feel you made certain good points in features alsomy blog – Dream Lift Skin Care

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Heey There. I discovered your bllg using msn. This iss an extremely

neatly wrutten article. I will bee sjre to bookmark it aand return to readd extra of youjr helpful info.

Thanks ffor the post. I’ll certainly comeback.

Amazing! Itss genuinely anazing article, I have got much cear iidea onn the topoc oof fom thnis post.

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Wow, that’s what I was exploring for, what a data!

present here at this weblog, thwnks admin oof this weeb page.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Link exchante iis nothin eelse excepot it is only placing the

other person’s blpg link oon your pae att prope place and

oyher peron will also doo simkilar in support oof you.

Youu reslly mae itt seewm sso easxy with yojr presentation but

I fibd this topic too bbe really something which I think

I woould never understand. It seeems tooo complex and extemely bfoad ffor me.

I’m lopoking forrward for your nexxt post, I’ll try tto get the ang of it!

Thanks for sharing your thoughts about 31647. Regards

Your article helped me a lot, is there any more related content? Thanks!

Someone essentyially asdist to make severely articles I wpuld state.

Thiss is thee very fitst timje I frequented your web

pabe and thus far? I surprised wiyh the analysis you mzde tto makke this particular submit

incredible. Geat job!

Hey aree usung Worddpress ffor your blkog platform?I’m neww too the blog world bbut I’m trying to

gett stwrted and set up mmy own. Do youu need aany html codding expertise tto maoe

youjr ownn blog? Anyy helpp would be really appreciated!

I seriously love your website.. Great colors & theme. Diid youu buildd this website yourself?

Pease reply bac aas I’m trying to create mmy vsry own blog

annd want tto learn where youu gott ths from orr exacttly what

the theme is called. Kudos!

Hey I know this iss offf topiic buut I wass wondering if you knew of any widgets I could add tto my

blog thawt automatically tweet my newedt twitter updates.

I’ve bsen looiking for a plug-in likme this forr quite some tiime

aand wwas hoping maybe yoou would have somme experience wkth something lile this.

Please let mee know iff you rrun int anything. I truly enjoy readinhg your blog annd I look forward too yourr neew

updates.

Hi here to all, becaue I am in faact eager off readinbg thks web site’s post tto bee updated regularly.

It incluces fastidious material.

Gresat article.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your enticle? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.info/en-IN/register?ref=UM6SMJM3

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.com/ES_la/register?ref=T7KCZASX

It’s fantgastic that yyou aree gettinbg thoughts frm this piece oof writing as ell as ffrom our argument

madde att this time.

XkeO NEqedxmk kclSMif KzEKkHD gcYbCj gvskLafO CnXxQXRJ

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

покупка аккаунтов заработок на аккаунтах

Secure Account Sales https://buyaccountsmarketplace.com/

Online Account Store Account Exchange Service

account store accounts market

account selling platform guaranteed accounts

gaming account marketplace accounts market

account buying service marketplace-social-accounts.org

sell pre-made account account market

Выигрывай бабло в онлайн казино! Топ слотов, акции, советы для победы! Подписывайся

Игровые автоматы: секреты, тактики, промокоды! Заработай с нами! Реальные обзоры.

https://t.me/s/official_izzi/946

PuNaEQ qFrj ELRbwqz EODQSfB epOcB

Выигрывай реальные деньги в онлайн казино! Топ слотов, акции, стратегии для победы! Присоединяйся

Казино онлайн: фишки, тактики, бонусы! Поднимись с нами! Только честные обзоры.

https://t.me/Official_1win_1win/1501

buy pre-made account https://social-accounts-marketplaces.live

https://t.me/s/official_gizbo_gizbo

https://t.me/s/win1win777win

https://t.me/vavadaslot_777/367

Bitcoin price predictions

find accounts for sale https://social-accounts-marketplace.live/

https://t.me/s/wiwniwnwin

ready-made accounts for sale https://accounts-marketplace-best.pro

https://t.me/s/Official_1win_1win

Hello There. I found your blog using msn. This is

a really well written article. I’ll be sure to bookmark it and return to read more of your useful info.

Thanks for the post. I’ll definitely return. Life Experience Degree

buy fb ad account https://buy-ads-account.click/

facebook ad account for sale https://buy-ad-account.click/

buy aged facebook ads accounts buy facebook ads accounts

buy google ads agency account https://sell-ads-account.click

buy fb business manager https://buy-business-manager-acc.org/

facebook verified business manager for sale verified-business-manager-for-sale.org

tiktok ads account buy https://buy-tiktok-ads-accounts.org

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

By adhering to these tips, you possibly can optimize

your results while sustaining your health and safety.

Bear In Mind, the key to a successful cutting cycle lies

in careful planning and responsible usage. Keep In Mind, attaining the best results requires dedication to a strict food regimen and common train regimen. Proviron is

arguably most effectively used during a Dianabol cycle,

“acting as a wingman,” says Dr. O’Connor, to boost Dianabol’s

anabolic properties whereas lowering aromatization. Dianabol may also kick in sooner than some testosterone esters (such as

cypionate and enanthate), which have considerably longer half-lives.

When it comes to steroids, it’s essential to

grasp that not all are suitable for newbies. Some,

like Trenbolone, are primarily reserved for skilled

athletes. This potent steroid can have some extraordinarily harsh side effects of anabolic steroid use effects that

might deter novices from exploring other steroids sooner or later.

Moreover, a scarcity of aromatization can exacerbate HDL ldl cholesterol, as estrogen is cardioprotective.

This is why doctors are comfortable prescribing it to men worldwide who naturally

have low testosterone. Bodybuilders additionally stack trenbolone

with Anadrol; however, this must be seen as highly

toxic and an pointless stack for many customers.

We have seen Dianabol trigger gynecomastia in customers because of its estrogenic nature (1), with the aromatase enzyme being current.

This permits steroid users to select from a much wider menu of compounds to customize cycles.

Popular injectable esters like enanthate or cypionate take several weeks for blood levels to build up,

after which provide a slow tapered decline. The most evident benefit of injectable steroids is the

entire bypass of the liver when administered intramuscularly.

Because injectables keep away from the GI system totally,

they place no stress on the liver. Testosterone, Deca

Durabolin, Trenbolone, Primobolan, Equipoise and more. There are numerous injectable steroids to choose from, permitting better

cycle personalization.

Facet results from nonprescription steroid injections

are usually more extreme and may be life-threatening.

For these seeking to acquire substantial muscle mass, Trenbolone Acetate is a robust

anabolic steroid that delivers spectacular results.

It is known for helping customers obtain dry muscle mass in important amounts.

In conclusion, the choice between oral and injectable steroids is a private one, influenced by numerous elements

together with well being concerns, comfort, and individual tolerance.

At All Times seek skilled guidance to ensure the safest and best use of these substances.

For muscle progress, anabolic steroids must bind to receptors in skeletal muscle—the muscle tissue

in our arms and legs that we use for lifting and different movements.

This binding triggers changes in protein manufacturing specifically inside muscle cells.

Taking too much HGH and taking it for extended durations

can potentially result in some severe and scary health issues.

Trenbolone also increases IGF-1 substantially, and HGH will solely increase how the muscle responds to all this extra IGF-1.

This is a hardcore cycle for advanced customers as a outcome

of Tren has some extreme unwanted effects to cope with.

The Undecylenate ester permits for a peak release in Boldenone roughly 3-4 days after injection, with a sluggish steady launch of the hormone

to comply with for approximately 21 days. Boldenone Undecylenate is a testosterone

derived anabolic androgenic steroid that’s greatest known by the commerce name Equipoise given to it by Squibb in the 1970’s.

Human grade Boldenone would see some success in human drugs through

the 1960’s and 70’s however would finally be discontinued

by the top of the last decade. Since that time, the steroid has solely been available via veterinarian medicine and

underground labs with the Equipoise name dominating the market.

In order to lose body fats, you must burn more

calories than you eat, you have to be in a caloric deficit,

and this will maintain true with or without anabolic steroid use.

Unfortunately, a calorie deficit places our lean muscle tissue in danger as the

physique will usually take what it needs to have the ability to meet

its energy calls for from our lean tissue. Proper weight-reduction plan can significantly

protect our lean muscle mass, but it might possibly only go up to now.

Without the introduction of an anabolic steroid, some muscle mass will eventually and inevitably be

misplaced. EQ will tremendously defend you from this loss in lean tissue, and it has also been proven to have

some very nice conditioning effects on the physique.

The shot could additionally be uncomfortable, however the numbing treatment will take effect shortly.

Nandrolone is available in Australia, Belgium, China, India and the United Kingdom.

The producer stopped making nandrolone for reasons unrelated to its safety or

effectiveness. It is essential for readers to grasp that

stacks will improve the severity of unwanted aspect effects.

We often discover Deca Durabolin to be very suppressive of the HPTA,

and thus users ought to administer a PCT following cycle cessation. We have additionally seen Deca provide joint-rejuvenating qualities, which are particularly helpful for older bodybuilders

who’ve a history of lifting heavy. Furthermore, because of an absence of androgenicity, Deca Durabolin presents distinctive protection to hair follicles on the scalp and

helps to minimize back acne.

D-Bal is the legal steroid primarily based on maybe the most well-liked anabolic steroid of

all time, Dianabol. As Quickly As the 12-week cycle is

complete, customers can see vital enhancements of their muscle strength and size.

Relying on the steroid and its dosage, you could even placed on as much as 6 kilos of muscles on the end of the cycle!

Staying knowledgeable and cautious will assist you to benefit from anabolic steroids while minimizing dangers.

The danger of sudden death from cardiovascular complications in the athlete consuming anabolic steroids can happen in the

absence of atherosclerosis. Thrombus formation has been reported in several case studies of bodybuilders self-administering

anabolic steroids (Ferenchick, 1991; Fineschi et al., 2001; McCarthy et

al., 2000; Sahraian et al., 2004). Melchert and Welder, 1995 have suggested that using

17α-alkylated steroids (primarily from oral ingestion) likely present

the best danger for thrombus formation. Proviron, because

of it being an oral steroid and failing to transform into estrogen, ends in vital

increases in complete cholesterol (with HDL ranges reducing and LDL ranges

spiking). Thus, we see Proviron inflicting notable increases in blood stress (6).

Consequently, stacking it with oral steroids can pose cardiac

issues.

Post-cycle bodybuilders can experience a degree of muscle atrophy and decreased neurotransmitter ranges,

which might trigger dependence in some bodybuilders. A particular

person with a better physique fat may observe reduced effects with this cycle, as although it might induce weight loss, its diuretic effects may be obscured

by elevated fats stores. Nonetheless, such reductions are mild in contrast to different anabolic steroids.

This mixture of testosterone and Deca Durabolin is the least toxic bulking stack in our

expertise. Intermediate customers will generally administer this stack once their body comfortably tolerates testosterone-only cycles.

Each steroid is different by means of how quickly

you can start seeing results, and your coaching and food plan will play a significant position in how

huge you’re going to get and how fast you’ll get there.

Injectable steroids naturally work much faster than orals like Dianabol.

For most steroids, you are looking at a number of

weeks, which is why you need to stick with a beneficial cycle size in accordance with which AAS you’re going to use.

This might be the best stack ever for slicing – it actually

was for me! All three compounds mix to ship a tough and ripped physique, and they can do this at pretty unfastened doses

thanks to the unbelievable means they all work collectively.

A stack of two of probably the most legendary chopping steroids can’t allow you to down.

Anavar is a pleasant delicate steroid and, at moderate doses,

is side-effect-friendly.

Making An Attempt to drag off too much weight is

a typical mistake for brand new gear customers. For a

12-week cycle, you’ll be able to run Anavar for the complete cycle at 40-60mg every day.

Primo can start low at 400mg weekly and be increased to 600mg from week five onwards.

This stack will help redefine the scale you’ve already placed on, particularly with the inclusion of Primo.

The healing properties are a bonus, and with elevated nitrogen retention, you will keep lean mass whereas shredding off fat.

It is a killer combo, with Primo included, due to the quality features it delivers.

You won’t be placing a lot measurement on with this stack, but

it’s good for cutting.

Useless to say, you have to be heavily skilled with utilizing testosterone compounds before diving into this cycle.

You’ll have already got a solid foundation in what impacts

testosterone steroids have on you, so you’ll have an idea of what to anticipate at greater doses and

the way to cope with unwanted side effects.

Over time, as a steroid person, you’ve accrued the expertise to work out how to get a prescription for steroids (Lucia)

your body reacts to totally different compounds, cycle lengths, dosages,

and every side of a steroid cycle. This allows

you to design an advanced steroid cycle protocol to deliver maximum outcomes

for your specific objective. It’s not unusual for intermediate and even some newbie

steroid customers to assume they’re prepared to jump into a sophisticated cycle just because there are a number of

steroid cycles beneath the belt.

They mostly use anabolic steroids, human growth hormone (HGH), and insulin. While these help,

they also carry big health dangers if not used proper.

Trenbolone stands out for delivering both muscle mass improve and

fat loss simultaneously.

All potential measures have been taken to ensure

accuracy, reliability, timeliness and authenticity of the information; nevertheless Onlymyhealth.com does

not take any legal responsibility for a similar. Utilizing any info provided by the net site is solely at the

viewers’ discretion. The time frames vary, however most of the products are described as producing noticeable results within weeks.

For example, customers of Crazy Bulk Bulking Stack reportedly feel effects

inside days. HyperGH14x isn’t just another overhyped product; it’s

a scientifically formulated supplement designed to stimulate your physique’s natural production of Human Development Hormone (HGH).

In 2024, SARMs like Testol a hundred and forty are redefining what’s possible in pure bodybuilding.

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you, your article surprised me, there is such an excellent point of view. Thank you for sharing, I learned a lot.